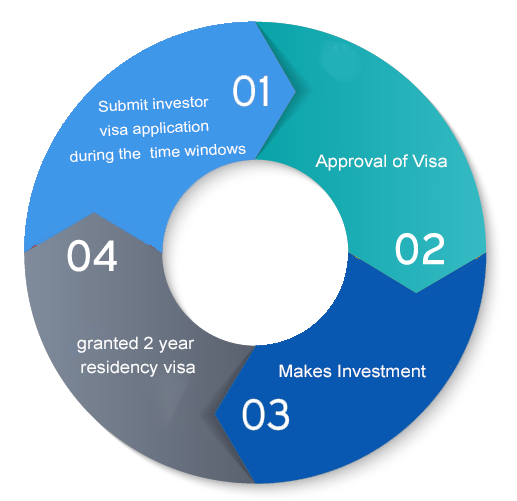

To get an Ireland PR, most people will invest in the Ireland golden visa program or known as IIP Programme (Immigrant Investor Programme). This visa will enable investors and their families to secure a Stamp 4 residency status in Ireland, which will allow the investor to work, study, or start their own business in Ireland. Of all the EU golden visa programs, the IIP is the only EU program that only upon your visa approval, then your investment follows.

Ireland is one of the sought-after countries for its pro-business environment. Some of the attractive pro-business environment include its low 12.5% corporate tax, highly educated & skilled English speaking labor force. Hence,it is not surprising that Ireland is the European hub for most of the biggest MNCs, including Goggle, Apple, Facebook, Intel, etc.

Every child is entitled to free, state-run primary as well as post-primary education and the classes are conducted in English. Every university in Ireland ranks among the top 5% of universities in the world. You may like to know that most employers ranked Ireland graduates No.1 in Europe.

Residency application will take about 4-6 months

After 5 years (1825 days of residency), you may apply for Ireland Citizenship. (12 months physical residency required prior to application*)

After visa approval, you will be granted a 2-year residency permit. After the 2 years, a 3-year permit will be granted/extended and every 5 years thereafter indefinitely.

There is no need for actual residency in Ireland but you are expected to visit Ireland at least once a year.

You can include your spouse, dependent children under the age of 24.

Ireland’s corporate tax is at 12.5%

Ireland is the only English speaking country in the EU and is a very sought after destination. Many of the applicants are attracted by the high level of education institutions present and the education help given. Given the cost of the UK investor visa is much more, the Ireland PR program is extremely well priced.

Moreover, through the CTA(Common Travel Area), all Irish and British citizens are able to move around either country. Under this agreement, they will be able to live, work, study and have access to social and health benefits.

Ireland’s economy is doing very well and currently having the highest economic growth rate in Europe. There is a possibility that Ireland might not need this programme in the future. Do contact us for more information on this limited opportunity.